5 Reasons the Payroll Process Is Vital to Any Organization

Why Payroll Process is Important?

The payroll process is one of the most important aspects of running a business. It is responsible for ensuring that employees are paid correctly and on time. Without a proper payroll system in place, businesses would struggle to function, and this can affect the business in so many ways, from failing to produce quality products or services all the way to hurting the company's reputation.

Reasons Why Payroll Is Vital to Any Organization

So, if you're wondering why exactly is the payroll process so important, here are five reasons it is vital to any organization:

1. Ensures Employees Are Paid Correctly

The payroll process is responsible for making sure that employees are paid the correct amount of money. This includes ensuring that overtime is paid correctly, that bonuses are paid correctly, and that deductions are taken out correctly. If the payroll process is not done correctly, employees could end up being underpaid or overpaid, which could lead to serious problems.

The payroll process is therefore very important and should be given the attention it deserves. This ensures you pay your employees correctly, avoiding any legal trouble and the like.

2. Ensures Employees Are Paid on Time

The payroll process is critical to the success of any business. It is responsible for making sure that employees are paid on time and accurately. This process can be complex, but it is essential to keep your employees happy and your business running smoothly.

Remember, happy employees work better for you, and sad employees do the opposite!

3. Helps to Manage Employee Benefits

The payroll process can help businesses to manage employee benefits in a number of ways. This includes things like health insurance and retirement savings plans. By managing these benefits through the payroll process, businesses can ensure that employees are getting the coverage they need.

In addition, the payroll process can also help businesses to track employee vacation and sick days. This information can be used to create an accurate record of employee attendance, which can then be used to calculate vacation and sick payouts accurately.

4. Helps to Track Employee Hours

The payroll process can also help businesses to track employee hours. This is important because it can help businesses to ensure that employees are not working too much overtime, which can lead to a drop in employee performance due to burnout and more.

Additionally, it can also help to identify employees who may be slacking off. This allows you to remind them that they have to step up to ensure they work their intended hours not only for your benefit but for theirs, too.

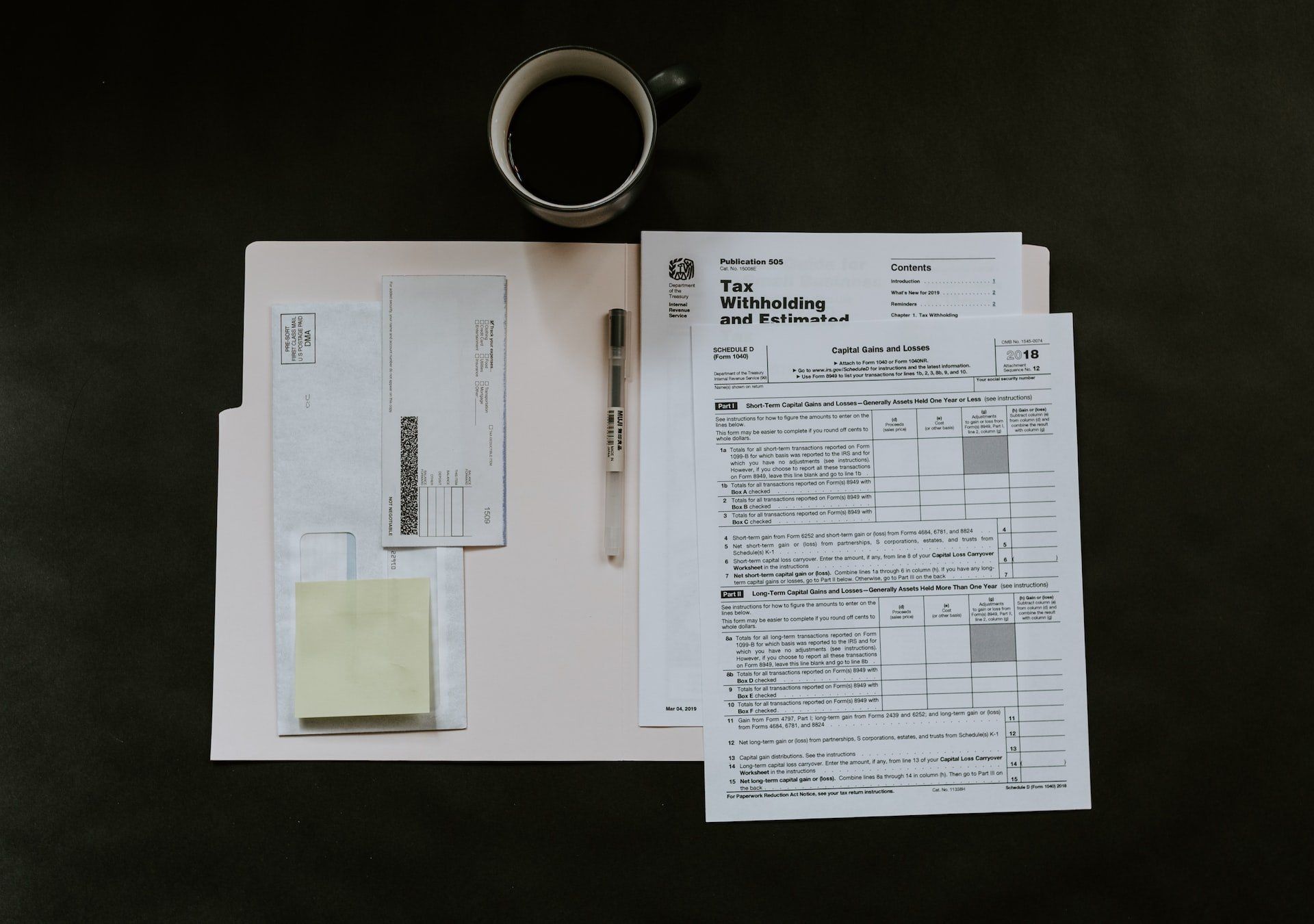

5. Provides Important Data for Tax Purposes

One of the biggest reasons payroll is so important is that it also provides businesses with important data for tax purposes. This data is essential to businesses to ensure that they are paying the correct amount of taxes.

We don't have to remind you that missing your taxes can lead to serious consequences. Keeping track and paying your taxes properly ensures you save as much money as possible in the process while still meeting your obligations.

Conclusion

As you can see, the payroll process is pretty important. While it seems only to focus on your employees, it really does encapsulate your entire business. So, make sure that your payroll process is done right and that any problems are fixed. That way, you can ensure your business processes go smoothly and that you stay on the road to success!

Acuff Financial Services offers comprehensive accounting solutions to help businesses achieve long-term financial success. Work with us today if you are looking for

accounting and payroll services in Loganville!