What Financial Services Firms Should Tell You about Form 1099

Things You Need to Know About Form 1099

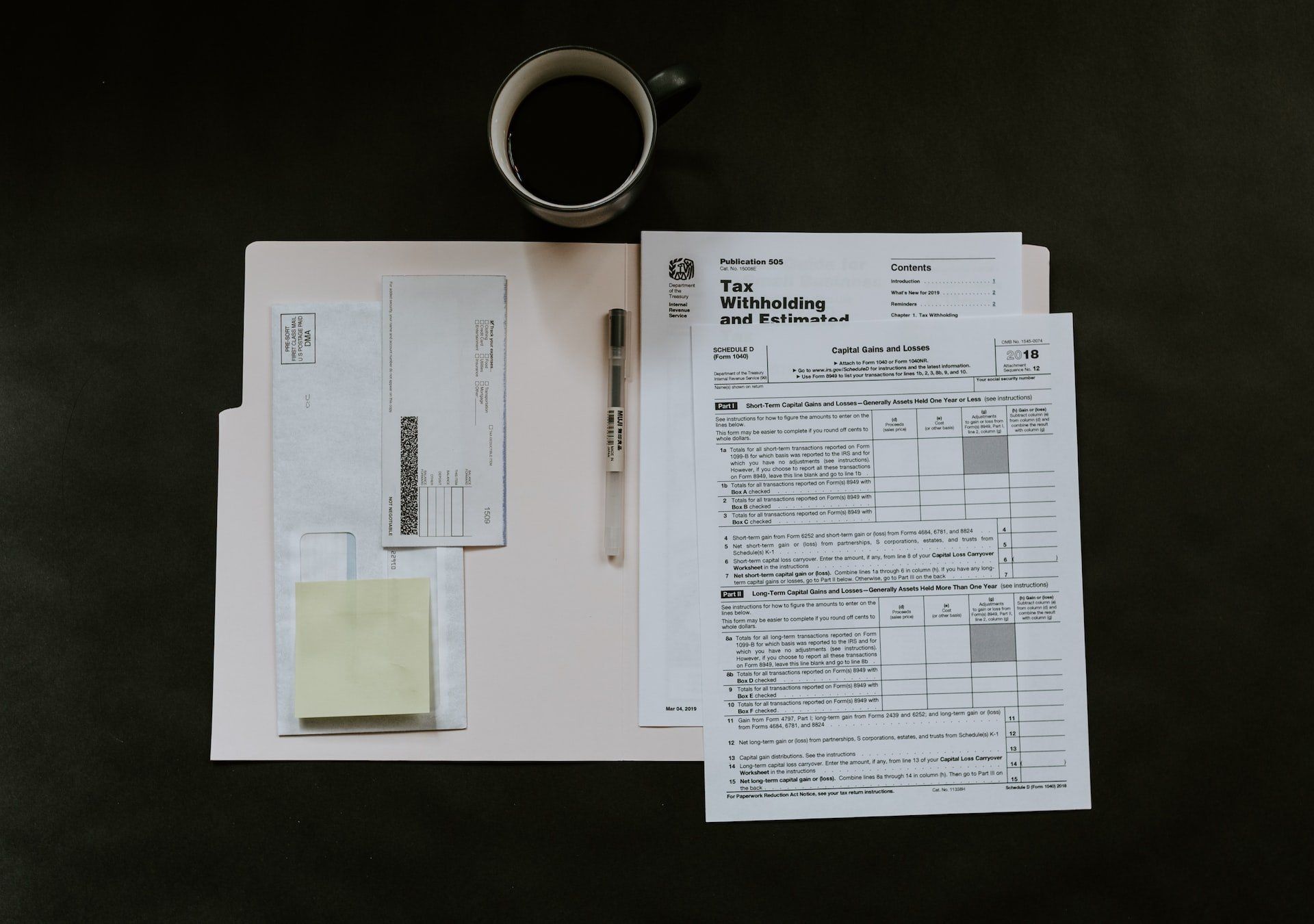

A 1099 form is an informational tax statement that reports your income from various sources during the previous year. This is typically used to report income from sources other than your employers, such as interest income from a bank account, investment account, or income from renting out property. You should receive a 1099 form for each type of income you received during the year, and you will need to mention this income on your tax return.

This is especially important if you enlist the help of a financial services firm. They must be on top of this lest they risk you getting penalized (and them losing a paying client). Here are some things they should tell you about Form 1099:

Accuracy Isn’t Guaranteed

If you receive a 1099 form with income that you know is not yours, you should contact the company that issued the form and let them know about the mistake. They will then be able to issue a corrected form.

The IRS may also make mistakes when counting forms, such as counting a 1099 form twice.

A good way to ensure your tax return is accurate is to compare the amounts on your Form 1099 with your records. If the information on Form 1099 is incorrect, request a corrected copy from the issuer.

If the IRS sends you a notice containing incorrect information, you should contact them immediately and explain the problem. Make sure to keep copies of all the letters you send to the IRS.

Income Has to Be Reported Even without Getting a Form 1099

The income amount you received may not require a Form 1099. This could be because the amount is under the limit for Form 1099 requirements or because it meets some other exception. Your payer could also have chosen not to send the form.

Despite these oversights, you must still report any income you receive in a year, regardless of the source. This includes money from jobs, investments, gifts, and anything else. If the IRS ever audits you, you must be able to show that all of your income was reported.

It’s Not Only You or the Financial Services Firm That Gets a Copy

The IRS receives copies of every Form 1099 that you receive. The IRS computers match the income and other information reported on these forms to the information reported on your tax return. This helps to ensure that you are reporting all of your income and paying the correct amount of tax.

The IRS may contact you if they believe you have inaccurately reported your taxes, which may result in you owing more money. Your financial services firm must be very careful about this.

These Forms Aren’t All the Same

These are just some of the 1099 form variations:

- 1099-MISC: This is the most common form of 1099, used to report income from freelance work, jury duty, or rental property.

- 1099-INT: This form reports interest income from savings accounts, bonds, and CDs.

- 1099-DIV: This form reports dividend income from investments like stocks and mutual funds. All are taxed at lower rates for long-term capital gains.

- 1099-G: This form reports government payments, like unemployment benefits or tax refunds.

Conclusion

Despite their numerous clients, your

financial services firm should be responsible enough to know these tips and also signal to you when you’re about to do something or not do something critical for

tax filing purposes. That’s why you should work with Acuff Financial Services, as our comprehensive services ensure you achieve long-term financial success without accruing any penalties when the taxman comes a-knocking. Visit our website and get in touch with us today!