Helpful Tips for Last-Minute Tax Filing

Last Minute Tax Filing

Tax filing can be hectic, especially for beginners with no idea where to start or what papers they need to begin the process. But what if you're almost to the deadline and you're still caught up with the stress of tax filing? The IRS deadline for tax filing is April 18, and if you're still scrambling to get your taxes done, don't worry; you're not alone.

Tips to Help Procrastinators File Their Taxes

According to a recent survey, nearly a third of Americans say they wait until the last minute to file their taxes. If you're one of those procrastinators, here are a few tips to help make the process a little less stressful:

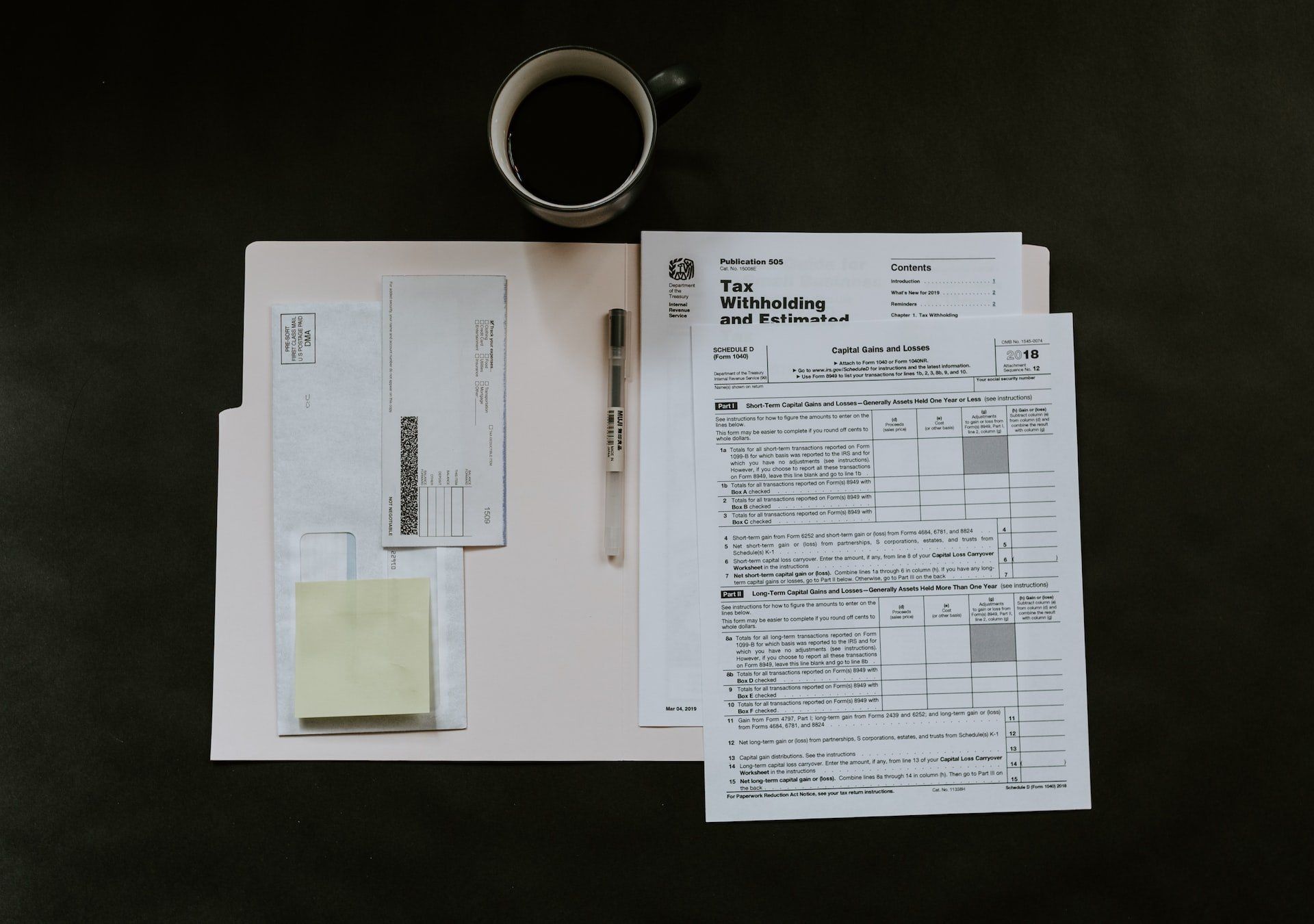

1. Know Your Tax Documents

If you register your taxes on paper, you need the W-2 form from each employer you worked for and the 1099 form from any other income you received. Aside from cash payments, you will need information about your property rentals, royalties, or other assets.

If you do your taxes online, you will need your W-2 form and any other forms that confirm your income and deductions. You must also submit your Social Security or Individual Taxpayer Identification Numbers (ITINs) for yourself, your spouse, and your dependents.

2. Get a Dedicated Accountant

Tax filing can be stressful for people with no knowledge about tax laws and procedures. You need to understand the tax laws and regulations of your country. So, if you’re not comfortable with tax filing and calculation, you can hire an accountant to get it done for you.

Many tax advisors can help you with the filing procedures and calculate your tax obligations. They will help you prepare all the necessary documents and submit the return on your behalf.

3. Organize Your Documents

Organizing your documents can be challenging, but it’s worth the effort. Having a system in place will make it easier to find what you need when you need it. There are a few different ways to organize your documents.

One way is to scan them and save them to your computer. This way, you will have all your documents in one place and make them easy to access. Another way to keep your records organized is to keep them in a separate area for easy access.

4. E-File Your Taxes

If you are nearing the tax filing deadline and want to spend less time on your tax return, perhaps you'd like to try e-filing them. E-filing your taxes will save you some time in printing and filling out all the paperwork by hand.

For example, if you e-file your taxes on time, you will not have to pay any penalties. However, you may still accrue interest on your owed taxes if paid past the due date.

5. Seek Help From a Tax Filing Agency

When worse comes to worst, and you're still feeling overwhelmed and under pressure because of the deadline, perhaps you'd consider consulting a tax filing agency.

Signing up for their financial services can save you time, money, and energy while providing peace of mind. Aside from that, they can help you stay compliant with all the regulations made by the IRS and maximize your tax return.

Final Thoughts

There's no need to feel stressed during tax season. These simple tips will help you enjoy the process of filing your taxes and getting a refund. Nonetheless, the best way to avoid tax mistakes is to ensure you take care of your taxes well. Tax deadlines are looming, and action is crucial to prevent added stress and penalties.

Acuff Financial Services provides reliable and

affordable

tax filing services, especially for those who don’t want to deal with last-minute filing. Get in touch with us today!