10 Tips on Choosing the Right Accountant for Your Business

How to Choose the Right Accountant?

Choosing an accountant for your business can be a daunting task. There are so many factors to consider, and it can be difficult to know where to start.

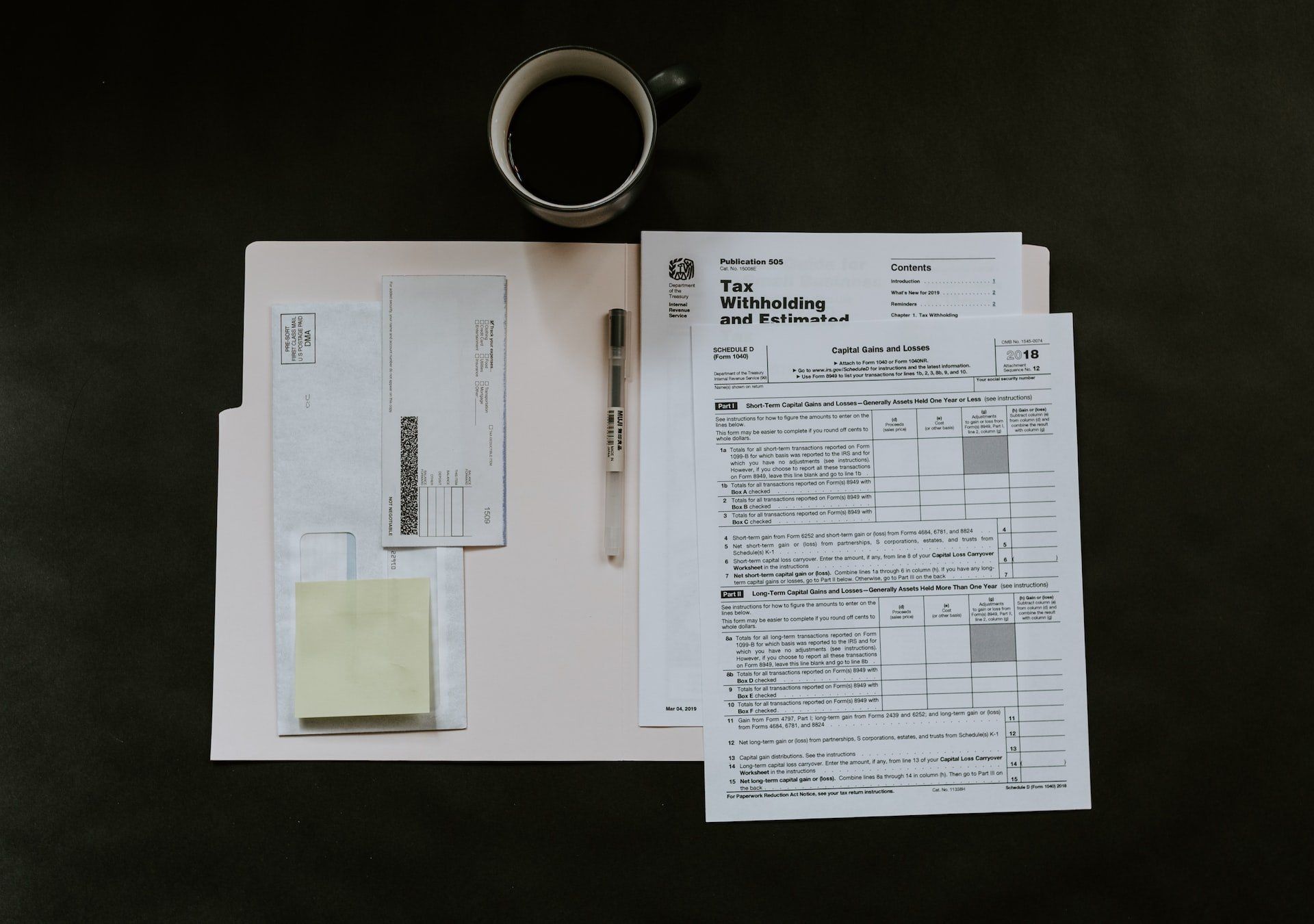

What Does an Accountant Do?

The first step is to understand what an accountant actually does. An accountant's job is to manage the financial records of a business. This includes keeping track of income and expenses, preparing financial statements, and filing taxes. An accountant can also offer advice on financial matters and help businesses save money.

Now that you know what an accountant does, here are ten tips on choosing the right one for your business:

1. Decide What Services You Need

Before you start shopping around for an accountant, you need first to decide what services you need. Do you need someone to help you with your taxes or do you need someone to manage your finances on a monthly basis? Knowing what services you need will help you narrow down your search and find an accountant that is a good fit for your business.

2. Consider Your Budget

Once you know what services you need, you need to consider your budget. How much can you afford to spend on an accountant? This will help you narrow your search even further and find an accountant you can afford.

3. Shop Around

Once you know what services you need and how much you can afford to spend, you can start shopping around for an accountant. Get quotes from different accountants and compare their rates.

4. Check Their Qualifications

When you're looking at different accountants, you should also check their qualifications. Make sure they have the experience and expertise that you're looking for.

5. Ask for Referrals

If you know someone with a business, ask who they use for their accounting needs. They may be able to give you a referral to a great accountant.

6. Read Online Reviews

If you're still not sure who to choose, read online reviews. Look for reviews from other business owners and see what they have to say about different accountants.

7. Make Sure the Accountant is Accessible

You should also make sure that the accountant you choose is accessible. You should be able to reach them when you need to, and they should be responsive to your questions and concerns.

8. Make Sure You're Comfortable With the Accountant

You should feel comfortable communicating with your accountant. They should be someone you can trust.

9. Choose an Accountant That's Familiar With Your Industry

It can be helpful to choose an accountant who is familiar with your industry. They will be able to offer insights and advice that are relevant to your business.

10. Get Everything in Writing

Before you agree to work with an accountant, make sure you get everything in writing. This includes their fees, services, and any other agreement you make.

Conclusion

There are many factors to consider when choosing an accountant for your business. The most important factor is to choose an accountant that is experienced and knowledgeable in the specific industry that your business is in. Other important factors to consider include the size of your business, your budget, and the

accounting services that you require.

Should you be looking for

affordable tax help, come to Acuff Financial. We are a comprehensive

accounting firm in Loganville, GA, committed to helping you pursue long-term financial success. Get in touch now!