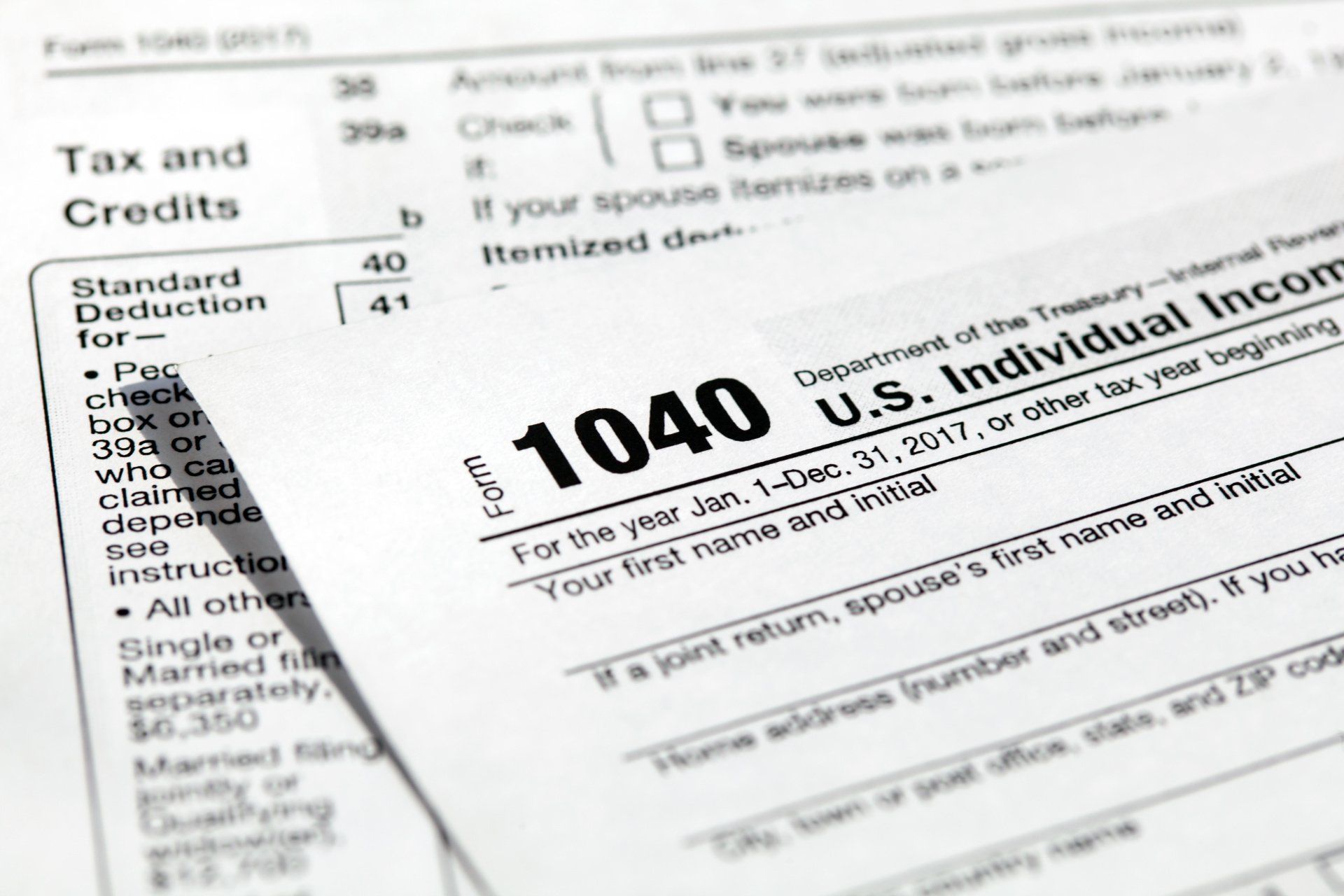

The Facts About Income Tax

Do you have a plan for your financial future?

Our Services

Tax

Accounting

Our President/Owner, Pete Flemming was recently awarded, "Best Tax Return Preparer in Walton County" for the third consecutive year.

Acuff Financial Services was also voted as

"Best Financial Firm in Walton County" for the second year in a row.

Certified Public Accountant in Loganville, Watkinsville, and Winder, GA

Acuff Financial Services is a comprehensive financial services firm committed to helping you pursue long-term financial success. With expertise in tax, accounting, and wealth management we offer customized programs that are designed to seek growth, and potentially conserve your wealth by delivering an unprecedented level of personalized service.

As today's economic, financial and tax landscapes become increasingly complex, a comprehensive approach to financial planning and investment management - one that considers your entire financial picture - can lead to clearer more confident financial decisions. That's because every financial decision, from your investment choices to financing a home, saving for retirement, funding a child's education, planning your legacy, or business planning - also carry important tax implications. Making financial decisions that ignore important components of your overall financial picture can lead to unintended consequences and ineffective outcomes.

Whether you’re facing retirement, starting a business, have accounting and management needs—or looking to better understand certain investment ideas—we can help you address your most pressing money questions.

Our first priority is your overall financial success. We want to learn more about your personal situation, identify your dreams and goals, and understand your risk comfort zone. Long-term relationships that encourage open and honest communication have been the cornerstone of our foundation of success.

Meet Our Team

Our Locations

Contact Details

Phone: 770-554-8344

Email: info@acufffinancial.com

-

Loganville Office

Phone: 770-554-8344

Fax: 770-554-8338

Address: 1920 Highway 81 Southwest

Loganville, GA 30052

-

Watkinsville Office

Phone: 770-554-8344

Fax: 770-554-8338

Address: Mars Hill Rd Suite 700

Watkinsville, GA 30677

-

Winder Office

Phone: 770-867-2149

Address: 18 W Candler St. PO Box 686

Winder, GA 30680

© Copyright 2024 | All Rights Reserved | Acuff Financial Services

Check the background of your financial professional on FINRA’s BrokerCheck .

Avantax affiliated financial professionals may only conduct business with residents of the states for which they are properly registered. Please note that not all of the investments and services mentioned are available in every state.

Securities offered through Avantax Investment Services℠, Member FINRA, SIPC, Investment advisory services offered through Avantax Advisory Services℠, Insurance services offered through an Avantax affiliated insurance agency.

The Avantax family of companies exclusively provide investment products and services through its representatives. Although Avantax Wealth Management℠ does not provide tax or legal advice, or supervise tax, accounting or legal services, Avantax representatives may offer these services through their independent outside business.

Content, links, and some material within this website may have been created by a third party [Faithworks Marketing] for use by an Avantax affiliated representative. This content is for educational and informational purposes only and does not represent the views and opinions of Avantax Wealth Management℠ or its subsidiaries. Avantax Wealth Management℠ is not responsible for and does not control, adopt, or endorse any content contained on any third party website.